Bipartisan Senate bill aims to more easily digitize paper tax return forms

As the IRS’s digitization efforts amid tax season continue, a bipartisan pair of senators are pushing for another technological change aimed at easing the processing of returns.

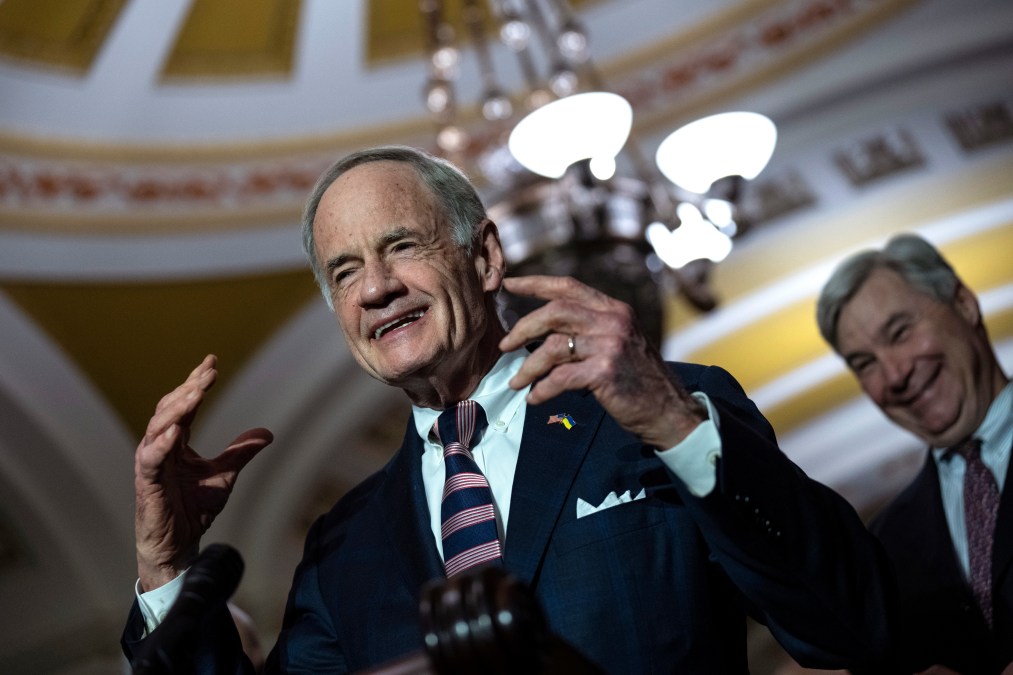

The Barcode Automation for Revenue Collection to Organize Disbursement and Enhance (BARCODE) Efficiency Act, introduced Thursday by Sens. Tom Carper, D-Del., and Todd Young, R-Ind., would require paper returns that are prepared electronically to include a scannable 2D barcode that the tax agency could easily convert to digital form, simplifying the processing of returns.

The bill calls for the use of allocated Inflation Reduction Act funding to implement the technology. The $80 billion infusion from the 2021 law has so far been used on everything from the IRS’s electronic Direct File pilot program to leveraging artificial intelligence to better identify tax avoiders.

“The main thing here is that this legislation will help the IRS conserve their resources, minimize processing errors and reduce delays in refunds to taxpayers,” a spokesperson for Carper told FedScoop. “And that’s really the core of what Sen. Carper cares about.”

Leading up to the launch of the IRS’s free electronic filing pilot program, which is available this year to select taxpayers in 13 states, Carper urged the agency to make the process more equitable and accessible, including in letters that he and Sen. Elizabeth Warren, D-Mass., sent to Commissioner Danny Werfel.

“As government officials, we have a responsibility to be good stewards of taxpayer dollars. That includes ensuring that tax returns are processed accurately and in a timely manner,” Carper said in a statement. By implementing “commonsense technology” called for in the bill, the IRS will be more efficient and ultimately “make a big difference for millions of American taxpayers,” he added.

The Government Accountability Office and the National Taxpayer Advocate have previously made calls to reduce paper returns and improve the processing of such returns. The 2D barcode method, which would eliminate the agency’s current manual transcription process, has been used by several state tax agencies, some for 20-plus years.

While more than 4 in 5 tax returns are now filed electronically, those who still choose the paper route represent a substantial cost and efficiency problem for the agency. The IRS’s Taxpayer Advocate Service in 2022 estimated that 50%-60% of the individual income tax returns submitted on paper and processed in 2021 and 2022 were prepared with tax return software and would not have required manual transcription if the 2D barcodes had been included.

Young, who has previously prodded the IRS on privacy and transparency issues from his time on the Senate Finance and Banking Committee, said in a statement that the bill will go a long way toward reducing the time it takes for the tax agency to process individual returns.

“Millions of Americans are forced to wait months — and sometimes years — for the IRS to process their tax returns,” Young said. “Our bipartisan bill will better serve taxpayers by improving the processing of paper returns, reducing errors, and requiring the IRS to operate more efficiently.”