IRS commissioner warns lawmakers about IT spending shortfall

The Internal Revenue Service was forced to make up a $600 million IT funding shortfall for the 2021 fiscal year by tapping its enforcement budget and user fees, the agency’s leader has warned.

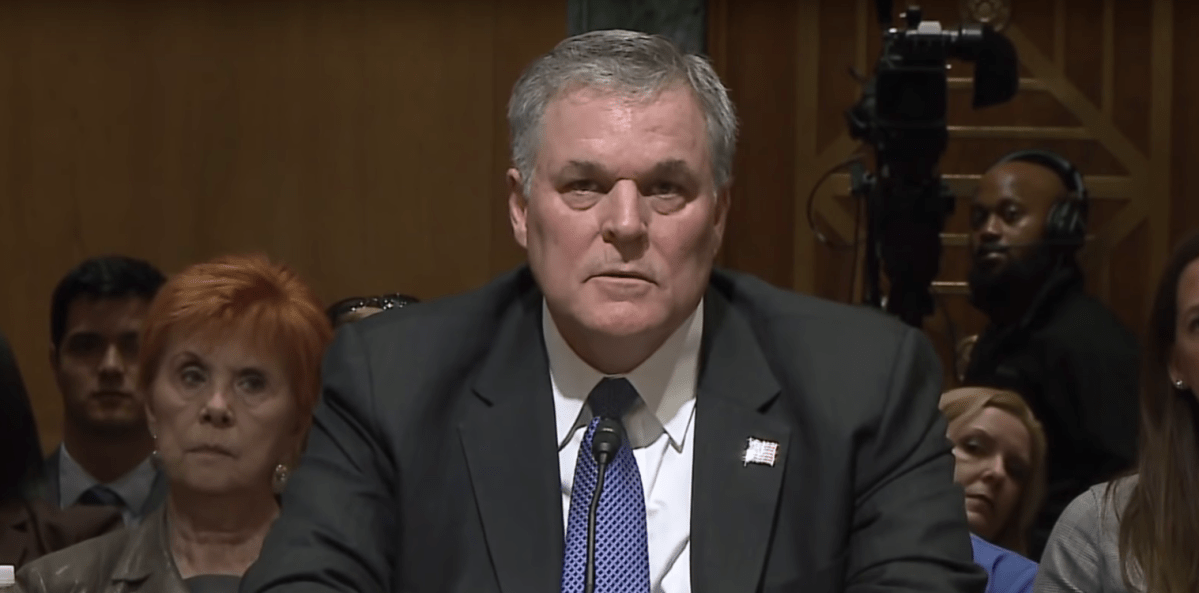

In a note to lawmakers late last month, Charles Rettig said the agency had recorded a significant rise in demand for its digital services during the COVID-19 pandemic and highlighted an urgent gap in funding for technology modernization.

“IRS’s technology needs are severely underfunded, a problem that has worsened over time as the demand for IT services grew and funding did not keep pace,” the IRS Commissioner wrote in the letter. “Each year, the IRS must take extraordinary measures to fund IT.”

During the 2021 fiscal year, the agency was forced to fund about $2 billion of the required $2.6 billion for IT systems from appropriations, according to the commissioner’s missive. Of the remaining $600 million shortfall, about $200 million came from enforcement, and about $400 million from user fees.

IRS’s systems came under particular strain at the height of the COVID-19 pandemic because of the demand for services delivering relief to citizens in addition to carrying out its responsibilities of tax administration.

The IRS is also contending with new statutory requirements that mandate IT investment in specific areas, as well as an increased threat to digital infrastructure from cyberattacks.

Rettig’s letter was sent in response to questions submitted by three Democratic senators in early August intended to identify further action needed from Congress to help IRS enforce the tax code.

Other conclusions from the commissioner’s letter include the finding that multi-year, consistent funding is necessary to help restore customer service and the demand for increased funding to help IRS mitigate the threat of cyberattacks.